Dental veneers are a popular cosmetic dentistry option that can greatly enhance the appearance of your teeth. However, the cost of veneers can be a concern for many individuals. If you’re contemplating getting veneers, you might be wondering if your insurance will cover the expenses. In this article, we will delve into the details of dental insurance coverage for veneers, providing valuable insights and offering practical tips to help you potentially secure some level of coverage.

Understanding Dental Veneers

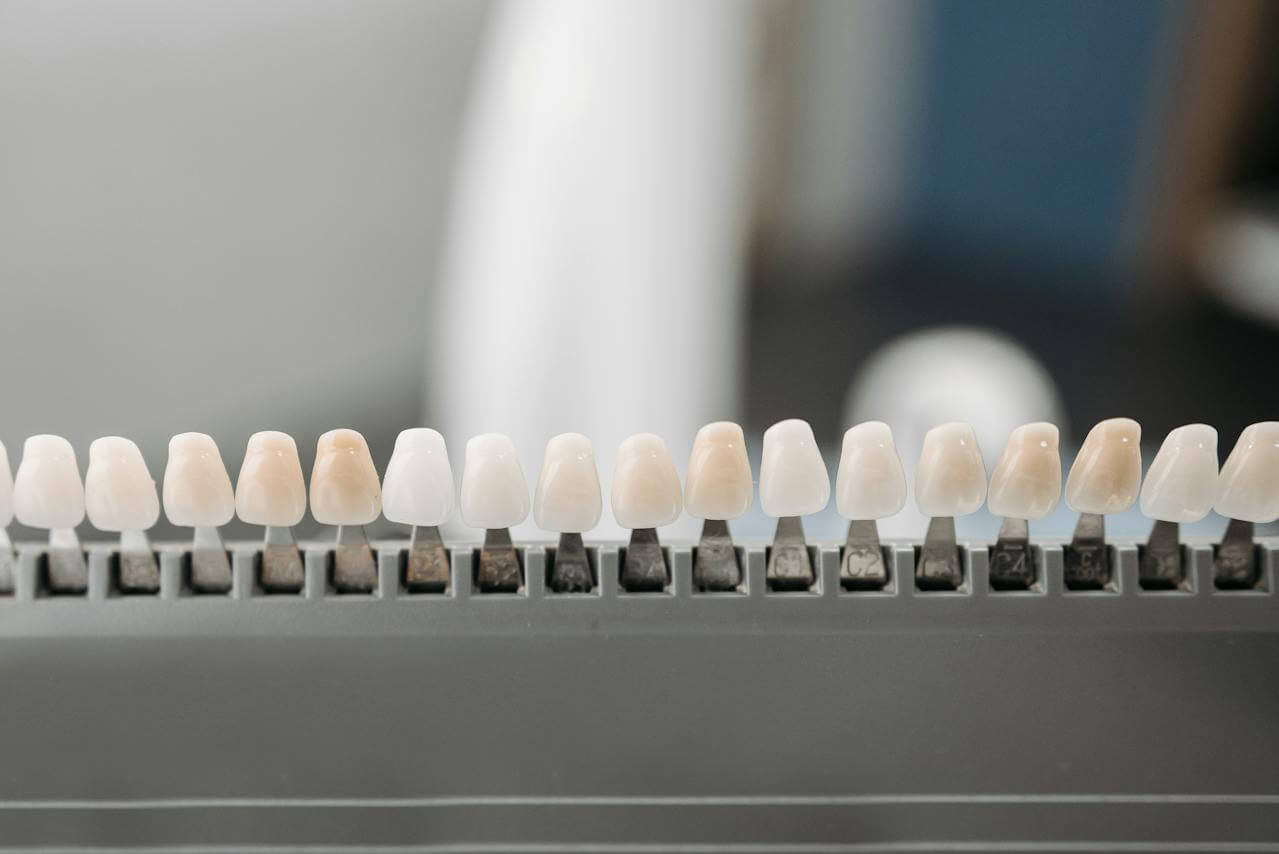

Dental veneers are thin, custom-made shells that are specifically designed to cover the front surface of teeth. They are used to enhance the appearance of teeth, giving them a more pleasing and attractive look. These veneers are typically made from two materials, namely porcelain or resin composite. The chosen material is then permanently bonded to the teeth, ensuring a long-lasting result.

Dental Insurance and Veneers

Most dental insurance plans classify veneers as a cosmetic dental procedure. Cosmetic dentistry encompasses various treatments aimed at enhancing the appearance of your teeth, although they may not be medically necessary. Consequently, many dental insurance plans do not provide coverage for cosmetic procedures, including veneers.

However, there may be exceptions where veneers are necessary for restorative purposes. For instance, they can be used to repair a damaged tooth or address specific dental health issues.

Step 1: Understand Your Dental Insurance Policy

To begin the process of determining whether your insurance might cover veneers, it is crucial to fully comprehend your policy. Take the time to carefully review your policy and look for specific information regarding the procedures covered and the conditions under which they are covered. If you find yourself uncertain about any aspect, it is advisable to contact your insurance provider directly for further clarification and guidance.

Step 2: Consult with Your Dentist

When you visit your dentist, take the opportunity to have a detailed discussion about your interest in veneers. Your dentist will conduct a thorough examination of your teeth to determine if veneers can be regarded as a restorative procedure specifically for your situation. If the evaluation proves favorable, your dentist can even provide you with a letter of necessity to submit to your insurance company, clearly outlining the medical justifications for the need of veneers.

Step 3: Pre-Treatment Estimate

When you visit your dentist, it’s a good idea to request a pre-treatment estimate, also referred to as a pre-determination, from your insurance company. This document will provide a comprehensive breakdown of the proposed treatment plan, as well as the costs associated with it. The insurance company will carefully review this estimate and provide you with a written response, outlining the specific coverage they will offer.

Step 4: Appeal if Necessary

If your insurance company denies coverage for veneers, and you strongly believe that they should be covered based on your policy and the medical necessity, you have the right to appeal the decision. You can seek assistance from your dentist to gather all the necessary documentation and evidence required to support your appeal. It is important to provide comprehensive details and compelling arguments during the appeal process to increase your chances of success.

Other Financial Options for Veneers

If your insurance does not cover veneers, or if the coverage is insufficient, consider the following options:

- Payment Plans: Some dental offices offer payment plans that allow you to pay for your treatment over time.

- Dental Discount Plans: These are membership-based plans that provide discounts on various dental procedures, potentially including veneers.

- Healthcare Credit Cards: Some companies offer credit cards specifically for healthcare expenses, which may offer promotional periods with low or no interest.

- Health Savings Account (HSA) or Flexible Spending Account (FSA): If you have an HSA or FSA, you may be able to use these funds to pay for veneers.

In conclusion, obtaining dental insurance coverage for veneers may pose challenges since they are typically classified as cosmetic. However, it is not impossible. To navigate this process successfully, it is crucial to thoroughly comprehend your insurance policy, consult with your dentist, and thoroughly explore all available financial options. By doing so, you can discover the most affordable and effective means to achieve the radiant smile you desire.

FAQs About How to Get Veneers Covered by Insurance

Q: Can dental insurance cover the cost of veneers?

A: It depends on your insurance policy. Some dental insurance plans may cover a portion of the cost if veneers are deemed necessary for medical, not cosmetic, reasons. Always check directly with your insurance provider to understand your coverage.

Q: How can I prove that my veneers are medically necessary?

A: You would need documentation from your dentist stating that the veneers are required to prevent or treat a dental health issue. This could include conditions like severe tooth decay, chipped or broken teeth, or chronic tooth sensitivity.

Q: What if my insurance company refuses to cover veneers?

A: If your insurance company denies coverage, you can appeal the decision. Consult with your dentist and insurance provider about the appeal process. Remember, it’s essential to know your rights as a policyholder.

Q: Are there any other ways to finance my veneers?

A: Yes, there are several options available if your insurance does not cover veneers. These include payment plans through your dentist, medical credit cards, personal loans, or health care flexible spending accounts (FSAs).

Q: Do all dentists offer veneers?

A: While many dentists offer veneers, not all do. It’s important to find a dentist who is experienced in performing this procedure. Always check a dentist’s qualifications and reviews before proceeding.

Q: How long do veneers last? Will insurance cover replacements?

A: Veneers typically last between 7 to 15 years, depending on care and lifestyle factors. Whether insurance will cover replacements largely depends on the reason for replacement and your specific insurance policy.

Q: What is the average cost of veneers?

A: The cost of veneers can vary widely based on the type of veneer, the complexity of the procedure, and your geographic location. On average, you can expect veneers to cost anywhere from $925 to $2,500 per tooth.

Q: Are there cheaper alternatives to veneers?

A: Yes, alternatives like dental bonding or crowns may be more affordable. However, the best option depends on your specific dental needs and should be discussed with your dentist.